Introduction:

Renewable energy stock has approved significant investments in electrolyser and lithium-ion storage plants to enhance green energy capabilities. Leadership changes reflect its commitment to innovation, sustainability, and strengthening its position in the renewable energy sector.

Share Price movement of Waaree Energies :

On December 23, 2024, Waaree Energies Limited opened at ₹2,922.00, up 2.39% from its previous close of ₹2,879.35. The stock reached a high of ₹2,968.00, a low of ₹2,830.45, and closed at ₹2,948.30, with a market cap of ₹84,699.71 crore.

Waaree Energies share price rise:

Waaree Energies Ltd’s Board, on December 23, 2024, approved major capital expenditures and investments. This includes Rs. 551 crores for a 300 MW Electrolyser manufacturing plant and Rs. 2073 crores for a 3.5 GWh Lithium-Ion storage cell plant, funded through debt and internal accruals.

Additionally, Rs. 130 crores will be invested in the inverter business via Waaree Power Private Limited, with Waaree Energies contributing up to Rs. 40 crores. The Board also acknowledged the resignation of Dr. Arvind Ananthanarayanan as Non-Executive Director due to professional commitments.

The Board appointed CEO Amit Paithankar as an Additional and Whole Time Director for five years, effective December 23, 2024, subject to shareholder approval. These decisions highlight Waaree Energies’ strategic focus on renewable energy and leadership restructuring.

Also Read: Nuclear stock in focus after it forms JV with High Technology FZ-LLC in Abu Dhabi

Recent news About Waaree Energies :

Waaree Energies IPO bidding started from October 21, 2024 and ended on October 23, 2024. The allotment for Waaree Energies IPO was finalized on Thursday, October 24, 2024. The shares got listed on BSE, NSE on October 28, 2024.

Ace investor holding of Waaree Energies :

Kalpraj Damji Dharamshi: Kalpraj Damji Dharamshi, a prominent ace investor, holds a 2.32% stake in Waaree Energies, amounting to 66,73,420 shares. His significant investment reflects confidence in the company’s renewable energy initiatives and long-term growth potential.

Also Read: Santa Claus Rally, Dividend Investing & More: Your Guide to Year-End Investing

Het Paresh Mehta: Het Paresh Mehta, another noted ace investor, holds a 1.22% stake in Waaree Energies, equivalent to 35,00,000 shares. This strategic investment highlights optimism about the company’s focus on innovation and its leadership in the renewable energy sector.

Stock performance of Waaree Energies for Period of 1 week:

Waaree Energies’ stock performance over the past week showed a decline of 6.41%. This reflects a short-term negative trend, indicating a potential market correction or sectoral movement, which investors may consider when analyzing the stock’s future trajectory.

Also Read: Navratna PSU stock jumps after it receives order worth ₹973 Cr

Shareholding pattern of Waaree Energies :

| Summary | Oct 24, 2024 |

| Promoter | 64.30% |

| FII | 2.20% |

| DII | 3.00% |

| Public | 30.50% |

About Waaree Energies :

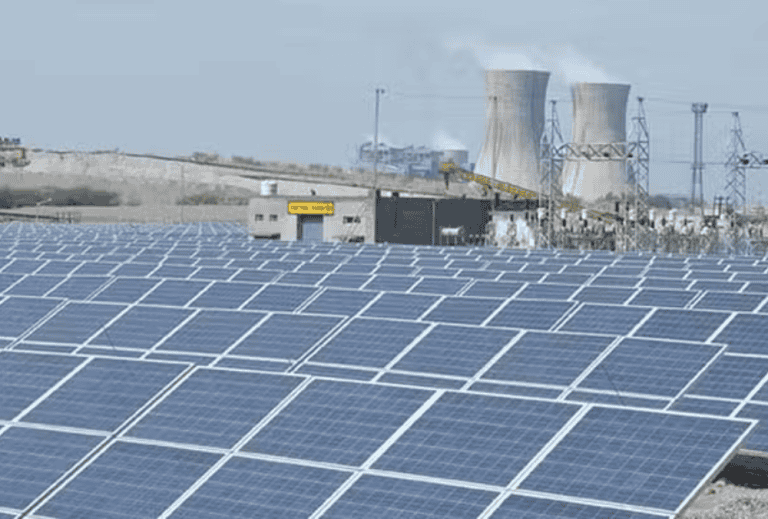

Waaree Energies is a leading renewable energy company specializing in solar energy solutions, including manufacturing photovoltaic modules and EPC services. Renowned for innovation and sustainability, it plays a key role in advancing clean energy adoption globally.

Disclaimer: The above article is written for educational purposes, and the companies’ data mentioned in the article may change with respect to time The securities quoted are exemplary and are not recommendatory.