Introduction:

Ambani Group infrastructure company has incorporated four new wholly-owned subsidiaries, focusing on engineering, research and development, and renewable energy. These entities aim to expand operations in engineering, green innovation, and clean energy solutions, with a nominal capital investment.

Also Read: FMCG stock jumps 7.7% after commencing production at its edible oil refinery

Share price movement of RIL:

On January 8, 2025, Reliance Infrastructure Ltd. opened at ₹309.60, up 0.07% from its previous close of ₹309.40. The stock reached a high of ₹311.40 (0.64%) and a low of ₹301.60. By 10:16 AM, it traded at ₹306.80, a 0.84% decline, with a market cap of ₹12,153.31 crore.

Reliance Infrastructure Expands with New Subsidiaries:

Reliance Infrastructure Limited (RIL) announced the incorporation of four new wholly-owned subsidiaries under Reliance Energy Limited (REL). The subsidiaries include Reliance Renewable Constructors Pvt Ltd, Reliance Green Innovation Pvt Ltd, Reliance Cleantech Mobility Pvt Ltd, and Reliance LoVE Pvt Ltd.

These subsidiaries span various sectors, with RRCPL focusing on engineering and procurement, RGIPL dedicated to research and development, and RCMPL and RLPL advancing renewable energy generation, transmission, and distribution.

The subsidiaries were incorporated with a nominal capital investment of ₹1,00,000 each, comprising 10,000 equity shares at ₹10 per share. The companies are newly formed and have not yet commenced operations, with no regulatory approvals or acquisitions required at this stage.

Recent news on RIL:

As of December 11, 2024, Reliance Infrastructure Ltd.’s subsidiary, Delhi Airport Metro Express Pvt. Ltd., along with Axis Bank, was issued a contempt notice by the Supreme Court for failing to refund over ₹4,500 crore to Delhi Metro Rail Corp. as per an earlier ruling.

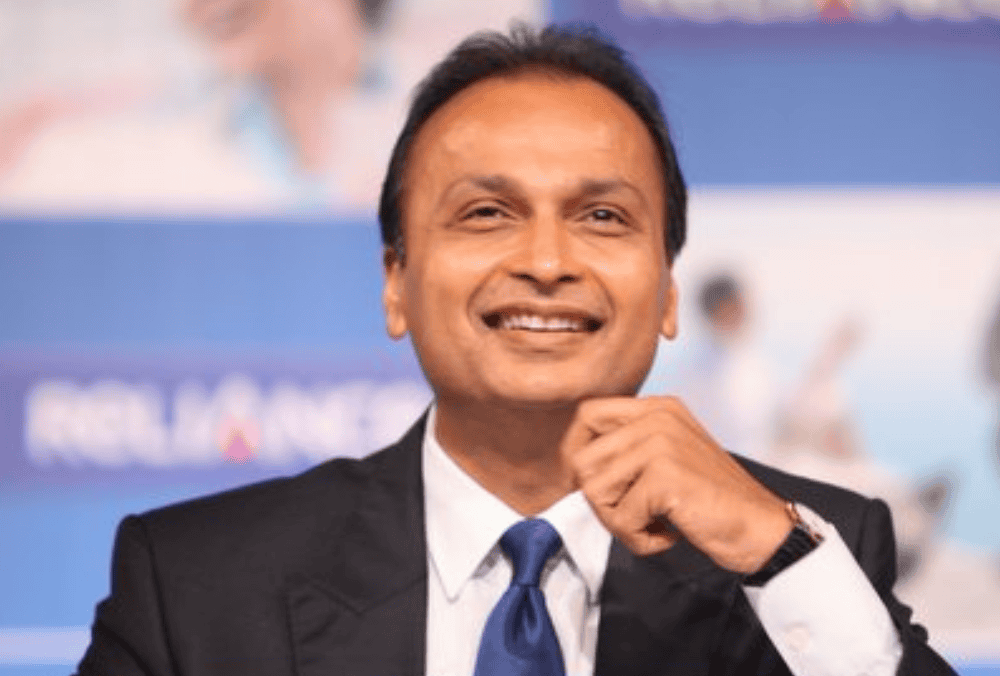

Ace investor holding in RIL:

Mathew Cyriac

Mathew Cyriac holds a 4.04% stake in Reliance Infrastructure Ltd., owning 15,985,841 shares valued at ₹487.7 crore. This significant holding underscores his investment in the company’s growth and development in the infrastructure sector.

Ketan Mohanlal Kakrecha

Ketan Mohanlal Kakrecha holds a 1.14% stake in Reliance Infrastructure Ltd., owning 4,500,000 shares valued at ₹137.3 crore. His investment highlights his confidence in the company’s potential and growth in the infrastructure industry.

Stock performance of RIL for Period of 1 week, 6 months and 1 year:

Reliance Infrastructure Ltd. has faced a 3.02% decline over the past week, but showed impressive growth with a 62.4% return over six months and a 30.7% return over the past year, reflecting strong performance in the infrastructure sector.

Also Read: Textile stock hits 5% upper circuit after it sets record date for 1:2 bonus issue

Shareholding pattern of RIL:

| All values in % | Sep 2024 | Jun 2024 | Mar 2024 |

| Promoter | 16.50% | 16.50% | 16.50% |

| FII | 8.40% | 12.40% | 11.80% |

| DII | 1.40% | 2.30% | 2.20% |

| Public | 74% | 69% | 69% |

About RIL:

Reliance Infrastructure Ltd. (NSE: RELINFRA) is a leading infrastructure company involved in power generation, transmission, and distribution. It operates plants and distributes power through its subsidiaries, BRPL and BYPL, serving millions of subscribers in Delhi.

Disclaimer: The above article is written for educational purposes, and the companies’ data mentioned in the article may change with respect to time The securities quoted are exemplary and are not recommendatory.