Synopsis:

NBFC stock’s board will meet on January 16, 2025, to review unaudited Q3FY25 results, consider a ₹10 equity share sub-division, and ensure SEBI compliance with a closed trading window until Jan 18.

Introduction:

NBFC stock’s board meeting on January 16, 2025, will review unaudited Q3FY25 results and propose a sub-division of ₹10 equity shares. Trading window closure remains effective from January 1-18, 2025, ensuring compliance with SEBI regulations.

Share Price movement of Last Mile Enterprises:

On January 13, 2025, Last Mile Enterprises Ltd opened at ₹407.95, up 0.62% from its previous close of ₹397.55. The stock peaked at ₹407.95, hit a low of ₹377.70, and traded at ₹400.00, with a market cap of ₹1,094.87 crore.

Last Mile Enterprises share price rise:

The Board of Directors of Last Mile Enterprises Ltd will meet on January 16, 2025, to consider unaudited financial results for Q3FY25, including the Limited Review Report and the Statement of Deviation/Variation Report, as per SEBI regulations.

The board will also discuss a proposal for the sub-division or split of equity shares with a face value of ₹10, subject to shareholder and regulatory approvals, along with amendments to the Memorandum of Association (MOA).

Additionally, the company announced its trading window closure from January 1 to January 18, 2025, in compliance with SEBI regulations to prevent insider trading during this period.

Also Read : Power stock in focus after it acquires Kudankulam ISTS Transmission for ₹7.4 Cr

Recent news About Last Mile Enterprises :

On December 28, 2024, Last Mile Enterprises Limited allotted 30,000 equity shares at ₹175 each to non-promoter Puneet Tondon upon warrant exercise. The shares, valued at ₹39.37 lakh, will rank equally with existing shares.

Ace investor holding of Last Mile Enterprises:

Adarsh Dharmendra Solanki holds 3,70,000 shares of Last Mile Enterprises Ltd., valued at ₹14.8 crore, showcasing significant confidence in the stock’s potential growth and stability, reflecting his strategic focus on impactful investments in promising business ventures.

Vicky R Jhaveri holds 3,54,250 shares of Last Mile Enterprises Ltd., valued at ₹14.2 crore. His substantial stake underscores a strong belief in the company’s long-term prospects and aligns with his investment strategy of identifying high-growth opportunities.

Stock performance of Last Mile Enterprises for Period of 1 week, 6 months and 1 year:

Over the past week, Last Mile Enterprises stock rose by 7.04%, showing short-term optimism. However, over six months, the stock experienced a steep decline of 44.8%. Despite challenges, it delivered a modest annual return of 3.88%.

Also Read : Penny stock to watch after company partners with Magicpin for gifting experience

Shareholding pattern of Last Mile Enterprises:

| Summary | Sep-24 | Jun-24 | Mar-24 |

| Promoter | 32.00% | 34.40% | 47.30% |

| FII | 14.50% | 17.00% | 8.40% |

| DII | 0% | 0% | 0% |

| Public | 53.60% | 48.50% | 44.30% |

About Last Mile Enterprises:

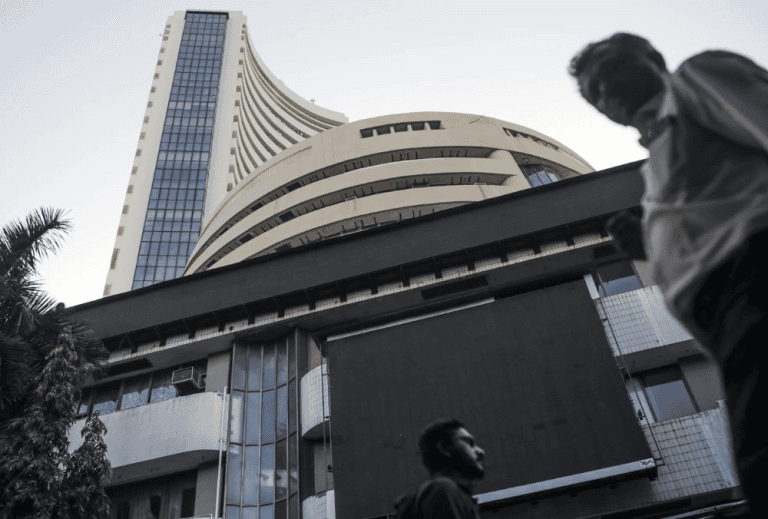

Last Mile Enterprises Limited is a dynamic NBFC engaged in financial services. The company focuses on providing innovative financial solutions, catering to diverse market segments, ensuring sustainable growth, and maintaining strong regulatory compliance, positioning itself as a key player in its sector.

Disclaimer: The above article is written for educational purposes, and the companies’ data mentioned in the article may change with respect to time The securities quoted are exemplary and are not recommendatory.