Introduction:

Leading PSU stock experienced significant price movement on January 6, 2025. The company clarified that no major announcements were responsible for the change, indicating the movement was likely market-driven.

Also Read: Infra stock jumps 4% after receiving order worth ₹1,391 Cr from NHAI

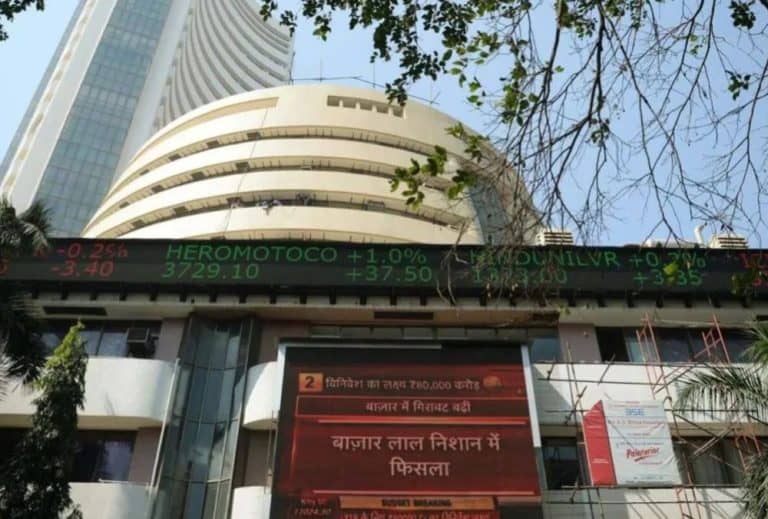

Share price movement of BPCL:

On January 7, 2025, Bharat Petroleum Corporation Ltd. (BPCL) opened at ₹287.60, up 0.83% from its previous close of ₹284.70. The stock reached a high of ₹290.55 and a low of ₹282.35. By 11:59 AM, it traded at ₹282.35, a 0.83% decline, with a market cap of ₹1,22,496.68 crore.

BPCL Addresses Recent Share Price Movement:

Bharat Petroleum Corporation Limited (BPCL) has informed that a significant price movement was observed in its share price on January 6, 2025. However, the company clarified there were no major announcements or developments triggering the change.

BPCL mentioned that while there was no official event influencing the share price movement, a news report indicated that Maharashtra Natural Gas Limited (MNGL), a joint venture of BPCL, BPCL’s partners, is preparing for an IPO worth over ₹1,000 crore. The IPO approval is pending regulatory clearance.

BPCL also noted that the price movement could be market-driven, with no official correlation to MNGL’s potential IPO. Investors are advised to consider the market dynamics as a factor in the recent change in share prices

Recent news on BPCL:

As of December 24, 2024, Bharat Petroleum Corporation Ltd. (BPCL) announced the approval for pre-project activities to set up a ₹95,000 crore greenfield refinery in Ramayapatnam, Andhra Pradesh, with a capacity of 9 MTPA, investing ₹6,100 crore.

Stock performance of BPCL for Period of 1 week, 6 months and 1 year:

Bharat Petroleum Corporation Ltd. (BPCL) has experienced a 2.60% decline over the past week, a 7.09% drop over six months, but a solid 25.2% increase in its stock price over the last year, reflecting overall positive growth.

Shareholding pattern of BPCL:

| All values in % | Sep 2024 | Jun 2024 | Mar 2024 |

| Promoter | 53.00% | 53.00% | 53.00% |

| FII | 15.40% | 15.00% | 16.80% |

| DII | 23.00% | 22.30% | 22.20% |

| Public | 8.60% | 9.70% | 8.00% |

About BPCL:

Bharat Petroleum Corporation Limited (NSE: BPCL) is a state-owned PSU engaged in refining and marketing petroleum products. It operates refineries in Mumbai, Bina, and Kochi, with a strong infrastructure network across India.

Disclaimer: The above article is written for educational purposes, and the companies’ data mentioned in the article may change with respect to time The securities quoted are exemplary and are not recommendatory.