Introduction:

RK Damani’s retail company reported a strong standalone revenue of ₹15,565.23 crores for Q3 of FY 2024-25, reflecting a significant year-on-year increase. The company continues to show consistent growth, operating 387 stores as of December 31, 2024.

Also Read: What are the new expiry days of Sensex, Bankex, and Sensex 50 Index derivatives?

Share price movement of Avenue Supermarts:

On January 3, 2025, Avenue Supermarts Ltd. opened at ₹3,790.00, up 4.75% from its previous close of ₹3,617.75. The stock reached a high of ₹4,165.00 (14.27%) and a low of ₹3,790.00. By 10:14 AM, it traded at ₹4,134.00, with a market cap of ₹2,69,013.05 crore.

Avenue Supermarts Reports Strong Q3 Performance:

Avenue Supermarts Limited reported a solid standalone revenue of ₹15,565.23 crores for the third quarter (Q3) of the financial year 2024-25, marking a significant increase compared to the same quarter in the previous year.

The company’s revenue for the quarter shows a growth trajectory, rising from ₹13,247.33 crores in Q3 2023 and ₹11,304.58 crores in Q3 2022, reflecting consistent performance across the years.

As of December 31, 2024, Avenue Supermarts operated 387 stores, demonstrating continued expansion. The financial results are subject to limited review by statutory auditors and are available on the company’s investor relations website.

Stock performance of Avenue Supermarts for Period of 1 week, 6 months and 1 year:

Avenue Supermarts Ltd. reported a 1.20% return over the past week. However, its six-month performance showed a decline of 25.6%, and the one-year return stood at -7.36%, reflecting mixed performance trends.

Also Read: Stocks to Consider for This New Year 2025

Shareholding pattern of Avenue Supermarts:

| All values in % | Sep 2024 | Jun 2024 | Mar 2024 |

| Promoter | 74.70% | 74.70% | 74.70% |

| FII | 10.00% | 9.20% | 8.30% |

| DII | 7.50% | 8.00% | 8.60% |

| Public | 8% | 8% | 9% |

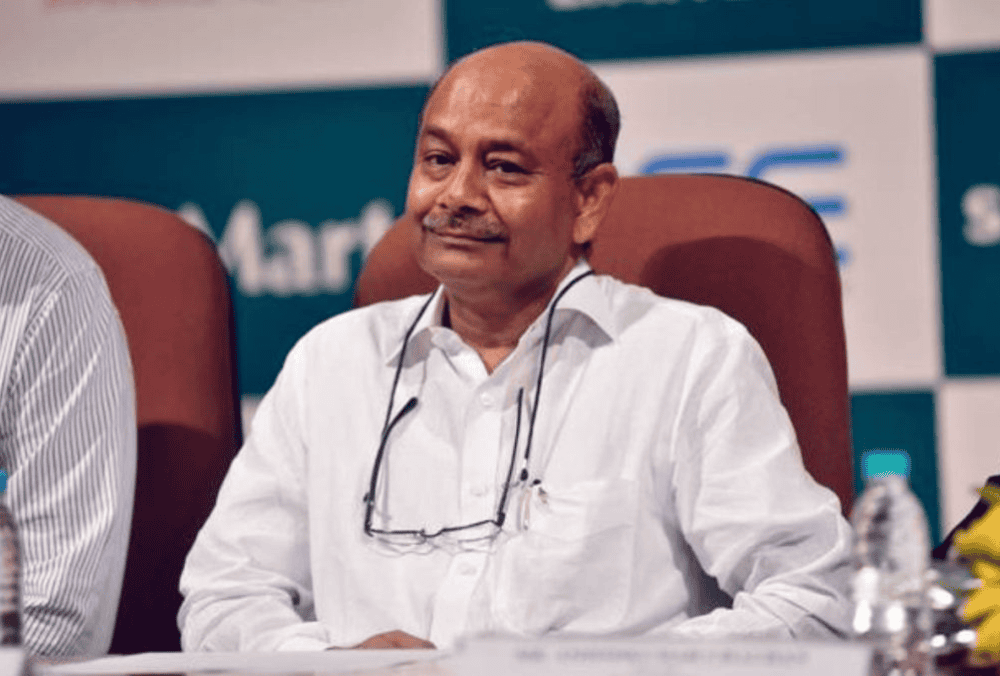

About Avenue Supermarts:

Avenue Supermarts Limited (NSE: DMART), founded in 2000, is a leading national supermarket chain specializing in value-retailing. It offers a wide range of products and operates 284 stores across India, with a retail business area of 11.5 million sq. ft.

Disclaimer: The above article is written for educational purposes, and the companies’ data mentioned in the article may change with respect to time The securities quoted are exemplary and are not recommendatory.